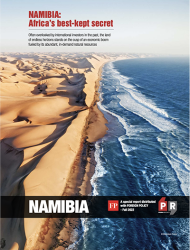

Namibia has arrived on the oil and gas scene

After two huge finds, the country has entered a new era of development and is ready to welcome international investors willing to participate in that predicted boom for oil and gas

Explorations led by Shell and TotalEnergies struck oil this year.

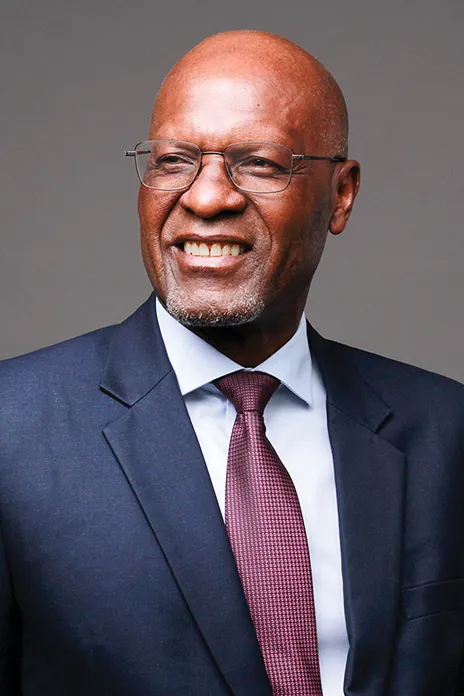

Namibia may have hit the oil jackpot this year, when its state-owned National Petroleum Corporation of Namibia (NAMCOR) announced that two world-class hydrocarbon discoveries had been made in deep waters off its southern coast. Both discoveries involve high-quality light oil and count among the top 20 most-significant discoveries in sub-Saharan Africa for many years. Both are the work of joint ventures: between NAMCOR, Shell Namibia Upstream and QatarEnergy on the one hand, and between TotalEnergies, QatarEnergy and Impact Oil & Gas on the other. Tests are now underway to determine the full potential of the finds, reveals Minister of Mines and Energy Tom Alweendo: “Together with the investors, we want to work as fast as possible to make sure that oil production starts and the discoveries contribute to our economy quickly. The impact could be huge and it is going to change the economic landscape of the country.” While Namibia is keen on exploiting its hydrocarbon reserves, it is not losing sight of its vast potential in renewable energy. The nation nourishes large ambitions to harvest its abundant sun and wind resources to produce green hydrogen. Up to $20 billion could be invested in green hydrogen. “Our resources for renewable energy are so large that we can help the globe to decarbonize,” stresses Alweendo. “We’re embracing both renewables and fossil fuel — we don’t see it as a contradiction. The global energy transition has to be a fair transition: countries with good hydrocarbon resources should be allowed to leverage those resources to manage their transitions. That will enable them to embrace renewables much faster or in a more resilient manner,” he asserts.

Last frontier for hydrocarbons

Namibia might be at the forefront of the nascent hydrogen industry, but it is a latecomer to the oil and gas game. Its four offshore and four onshore basins contain an estimated 11 billion barrels of oil and 2.2 trillion cubic feet of natural gas, and only around 24 exploration wells have been drilled in them to date. The very first explorative program in its waters reaped immediate rewards when Chevron found the Kudu gas field in 1974. Located in the same Orange Basin as the two latest discoveries, Kudu is thought to contain about 1.3 trillion cubic feet of gas. Unfortunately, exploration of the country’s resources stalled from this point until it gained its independence from South Africa in 1990, as sanctions on that nation at the time discouraged international involvement in Namibian hydrocarbons. Soon after it was freed from the burden of sanctions, however, Namibia’s government passed the Petroleum Exploration and Production Act of 1991 and established NAMCOR to help get the sector back on track. Initially, the entity acted as a regulator and advisor to the Ministry of Mines and Energy, but over the years, it transformed into a fully commercial public enterprise that participates upstream and downstream. “The role we play is to ensure the state has a participating interest in the sector at equity level in order to enable security of supply for the country. We’re there to make sure Namibia derives value at all levels in the form of royalties, taxes and equity,” explains its managing director, Immanuel Mulunga.

Namibia might be at the forefront of the nascent hydrogen industry, but it is a latecomer to the oil and gas game. Its four offshore and four onshore basins contain an estimated 11 billion barrels of oil and 2.2 trillion cubic feet of natural gas, and only around 24 exploration wells have been drilled in them to date. The very first explorative program in its waters reaped immediate rewards when Chevron found the Kudu gas field in 1974. Located in the same Orange Basin as the two latest discoveries, Kudu is thought to contain about 1.3 trillion cubic feet of gas. Unfortunately, exploration of the country’s resources stalled from this point until it gained its independence from South Africa in 1990, as sanctions on that nation at the time discouraged international involvement in Namibian hydrocarbons. Soon after it was freed from the burden of sanctions, however, Namibia’s government passed the Petroleum Exploration and Production Act of 1991 and established NAMCOR to help get the sector back on track. Initially, the entity acted as a regulator and advisor to the Ministry of Mines and Energy, but over the years, it transformed into a fully commercial public enterprise that participates upstream and downstream. “The role we play is to ensure the state has a participating interest in the sector at equity level in order to enable security of supply for the country. We’re there to make sure Namibia derives value at all levels in the form of royalties, taxes and equity,” explains its managing director, Immanuel Mulunga.

In 1991, the country undertook its first licensing round, with five bidders being awarded exploration licenses. Two subsequent rounds followed over the next decade or so, yet none led to commercializable finds. As a result, the country adopted an open licensing system in the mid-2000s, with companies welcome to apply for exploration acreage at any time. “This helped lead to another wave of interest between 2008 and 2012, with various investors coming in, mostly startups and smaller companies that acquired licenses and partnered with some larger independents,” Mulunga states. “During that period, Brazil-based HRT managed to prove an active petroleum system in our Walvis Basin.” In 2014, giants like Shell, TotalEnergies and ExxonMobil started to enter the market. “That was thanks to the enabling, conducive, robust and internationally competitive regulatory environment we have in place,” Mulunga explains. In addition to steady governmental support, NAMCOR has been instrumental in enhancing Namibia’s attractiveness for oil and gas majors. Mandated by government, the company today holds an average 10% stake in 98% of existing exploration licenses in the country, and a majority working interest in five exploration blocks. The company welcomes new investors in these assets and is strategically well placed to facilitate mutually beneficial negotiations between the government and its partners. NAMCOR is also the custodian of Namibia’s first-class hydrocarbon exploration databases and carries out specialized geological and geophysical studies on the blocks it has an interest in to support faster discovery and help de-risk investments.

A coming of age

Namibia’s hydrocarbon industry truly began to mature in 2021, when BW Offshore set a date of 2026 for Kudu to go into production and upped its holding in the field’s license to 95% by acquiring a large part of NAMCOR’s stake. The Norwegian firm intends to use a floating platform to extract the gas, which will be piped to a new gas-to-power plant on land in order to increase the country’s self sufficiency in lower-carbon electricity generation. That same year, ReconAfrica, a Canadian firm working under a joint operating agreement with NAMCOR, drilled test wells in the Kavango Basin that finally confirmed the presence of active onshore petroleum assets in Namibia. A year later, Shell and TotalEnergies made their headline-grabbing announcements. “We’re excited to be part of both these oil discoveries and we’re well poised to help make sure production happens by 2028,” Mulunga entrusts. According to a study commissioned from research and consultancy firm Wood Mackenzie on the back of the latest discoveries, oil and gas will probably double Namibia’s gross domestic product by 2040 to about $35 billion, with the industry creating thousands of jobs.

Until then, billions of dollars of investment are poised to enter the nation as it prepares for its first commercial oil extractions, Mulunga says: “We’ve already received interest from other international oil companies that want to be part of this bonanza and hope to attract them not only to explore in the Orange Basin, but in all our other basins as well. We’re at the frontline of a new industry being created in Namibia and we have to make good use of this window of opportunity, as the energy transition is something that we’re embracing as a company and as a country.” The evolving sector’s ecosystem will encompass a myriad of new opportunities in oilfield services, many of which are likely to be provided by foreign businesses in partnership with local suppliers, he points out: “We’ll see Namibian companies springing up to serve this emerging industry, while towns and cities like Windhoek, Walvis Bay and Lüderitz will experience significant and rapid economic growth.”

Aggressive expansion

NAMCOR’s 10% interest in both of 2022’s oil finds will turn it into Namibia’s largest company once production commences. It has already grown exponentially in recent years. “When I started as managing director in 2015, our annual revenue was about $34 million. This financial year, which ends in March 2023, we expect our total revenue to be around $330 million — that’s almost a tenfold increase and most of it has come from our downstream business,” Mulunga notes. The company ventured into the downsteam segment in the early 2000s when it began to import petroleum products for commercial sale. Yet that business really took off in 2014 when it decided to enter the retail sector, which offered better margins than its commercial activities securing long-term sustainability. NAMCOR opened its first three service stations in 2019 after investing in new branding and logo. Since then, the company’s outlets have mushroomed all over Namibia, including in strategic locations such as the Hosea Kutako International Airport, offering their customers an innovative range of services like convenience stores, ATMs and free wifi. By 2024, NAMCOR aims to expand its network to 33 stations across the country.

“Gaining critical retail mass was important for us in order to play a meaningful role in the economy and to compete against established international companies, so we’ve employed an aggressive expansion strategy,” explains Mulunga. This approach is working, as NAMCOR has already secured 15% of the downstream market. The company has also put concerted effort into growing its commercial sales of high-quality competitively priced branded fuels and lubricants that are trusted by major operators in mining, transport, construction and many other sectors. It oversees an extensive and secure network for distribution and storage of its products, and the strong reputation it has amassed in these areas led to it beating off international competition to win the government contract for operating and maintaining the new National Oil Storage Facility at Walvis Bay.

Opened in 2021, this multi-billion-dollar facility boosts the country’s fuel reserves from 7-10 days to at least 30 days. It will be used by NAMCOR for trading purposes and positions Namibia as a gateway for the supply of fuel to its African neighbors. 2021 also saw NAMCOR expand internationally for the first time. “While waiting for our own discoveries in Namibia, our strategy was to use the skills, expertise and educated workforce we have gained from our participation in the Kudu gas-to-power project to explore for opportunities further afield in the form of upstream producing assets being sold by international oil companies,” says Mulunga. Having submitted a robust bid, it was awarded one producing and two exploration blocks in Angola that Sonangol had put up for sale.

There are a number of reasons why NAMCOR opted to buy production capacity outside of the country, he adds: “One aim was to guarantee that we had sustainable cashflow to secure our financial self-sustenance. It will also provide NAMCOR with experience to employ in our own upcoming development and production activities at home — it’s almost like a dress rehearsal.” Fostering a highly capable, well trained Namibian workforce is something that is of supreme importance to the executive. “When I came to NAMCOR, I took time to bring in additional skills from outside to supplement the executive team. There are very skilled people in Namibia that you can draw into any company with the right leadership and that’s how we managed to attract the competent and experienced people that allowed us to transition into new activities, such as retail and management of the National Oil Storage Facility, extremely well.”

When it comes to oil production, however, NAMCOR will be competing for a much rarer skills base. To surmount that challenge, it is working hard on talent management. In March, it signed a wider cooperation agreement with QatarEnergy for oil and gas exploration and production, whereby Namibian workers will be upskilled to meet the new business models that are now emerging in the nation’s upstream sector. Like Minister Alweendo, Mulunga expresses confidence for the future. “Namibia has arrived on the global scene of oil and gas. We’re ready to play a meaningful role as a petroleum-producing country and in the energy transition as a hub for green hydrogen. We will use our oil and gas fortunes to get the country out of poverty and to make sure that Namibia can be one of the shining examples in Africa and on the global level when it comes to energy and good governance.”

Report Contents

Download the PDF

Download the PDF