Diamonds: A sparkling case study for responsible mining

As Namibia seeks to make the most of its in-demand resources, the country's mining sector is flourishing. Commodities include highly desirable minerals that are vital for the global energy transition, such as uranium, as well as ethically produced, premium-quality diamonds

Sorting and valuing rough diamonds are highly skilled tasks NDTC employees fulfill.

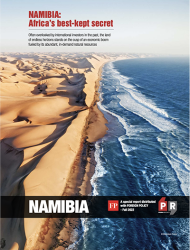

Almost 62% of all foreign investment in Namibia is directed to extracting the wealth of minerals in its soils and waters. “Mining currently contributes 10% of our gross domestic product (GDP) and it’s a growing sector,” says Tom Alweendo, Minister of Mines and Energy. “The minerals we’ve traditionally produced the most are diamonds, gold and we’re the second-largest producer of uranium globally, as of 2021.” Namibia’s resources also span copper, lithium, cobalt, tungsten, tantalum and other key elements of the energy transition, he adds: “We have rare-earth minerals for renewable energy and encourage investors to explore them.” Some already are, including Australia’s Lepidico and Canada’s Desert Lion Energy, which are mining lithium. Hilifa Mbako is executive chairperson of Orano Mining Namibia, a French state-owned firm that has around $670 million invested in a huge uranium mine. He recommends the country to potential investors: “Most companies mining here are foreign and it’s one of the best jurisdictions any of us has experienced.” Alweendo issues a word of caution, however: “We want investors to really add value to our minerals in the country, rather than just exporting them in their raw form.”

Namibia’s extremely high-quality, sustainably recovered and conflict-free diamonds are a sparkling illustration of how mining can add value. “We’ve been recovering diamonds for more than 100 years, over which time the industry has had a significant positive impact on the development of our economy, communities and people,” says Brent Eiseb, CEO of Namibia Diamond Trading Company (NDTC), a 50:50 joint venture between the state and leading diamond producer De Beers.

NDTC is responsible for sorting, valuing and selling all the country’s rough diamonds, which amounted to nearly 1.5 million carats in 2021, as well as ensuring downstream value addition takes place within the country. The diamonds are recovered by two other government-De Beers joint ventures: Namdeb recovers them from beaches and shallow waters, while Debmarine is the global leader in marine diamond recovery and operates off the coast in the world’s richest marine diamond deposits. NDTC’s highly skilled employees, assisted by in-house technology, then sort and value each rough diamond, Eiseb notes: “We’ve got 13,000 different classifications and it’s an important process, because it’s on the basis of our valuation that taxes, royalties and levies are paid. Diamonds account for 7-8% of GDP and, for every dollar Namibia generates from diamonds, about 80 cents ends up in government coffers, which has contributed to Namibia’s excellent infrastructure.” These tasks require rare skills and NDTC provides comprehensive training to build capacity and opportunities for citizens.

NDTC then distributes the diamonds through three channels: some are sold to De Beers, 15% go to the state-owned Namib Desert Diamonds and about $430-million worth are sold to 11 handpicked clients every year, who are required to process them in Namibia, he reveals: “We’ve created a sustainable and viable cutting and polishing industry in the country, generating employment and knowledge transfer.” The next step is jewelry design and manufacturing, and NDTC is working with others to find ways to promote Namibia’s designers internationally and to furnish them with technical and business skills. The Namibian diamond industry has seen phenomenal growth in the last two years. “That was primarily driven by record consumer demand, particularly from the U.S., which accounts for 52% of global diamond jewelry sales,” explains Eiseb. Optimistic that robust demand for its ethically produced gems will continue, the industry is making sure the supply will be there to meet it, he adds: “Namdeb has extended its mining operations until 2042 and Debmarine has commissioned a new vessel that will add about half a million carats to Namibia’s production on an annual basis.”

Report Contents

Download the PDF

Download the PDF