Banks: Strong, trusted partners for growth

Firmly rooted in their country, Namibian banks are effective and dynamic catalysts of sustainable economic development that benefits all stakeholders

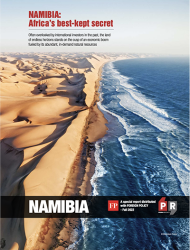

Standard Bank’s new head office in Windhoek, Namibia

Resilient, liquid and profitable, Namibia’s banking sector contains eight institutions. One of them, Standard Bank Namibia, has supported the nation’s development for over 100 years. “Namibia is our home and we drive its growth,” asserts CEO Mercia Geises. A top-three bank by market share, Standard Bank Namibia has substantial client bases across personal, corporate investment, business and commercial banking. Since 2019 when it was listed on the Namibia Stock Exchange, 25% of the bank has been owned by the general public, including many of its over-1,400 employees. The remainder is held by its parent, Standard Bank Group, which has an on-the-ground presence in 20 African countries, an integrated worldwide network of operations and is the continent’s third-largest bank in terms of assets.

Within its corporate investment activities, Standard Bank Namibia stands out in key sectors, Geises reveals: “As investors and banking partners, our expertise is dominant in mining. We also have expertise in oil and gas locally and in the wider group, in partnering with non-bank financial institutions for banking services, in fast moving consumer goods and in agriculture. Our understanding of local, African and global dynamics makes us an extremely strong partner.” Geises became CEO in 2021 and was tasked with refreshing the bank’s strategy in alignment with that of the parent group and emerging opportunities in the Namibian economy. “I’m leading the transition from a traditional bank to a purpose-led, platform-based business,” she explains.

To build a future-ready platform, Standard Bank Namibia is investing in its digital capabilities, particularly in areas like cloud technologies, and it has acquired one of the country’s biggest fintech firms in order to revitalize the way remittances are handled in Africa. Already, however, it offers first-class digital services, states Geises: “Among our biggest innovations to boost financial inclusion is PayPulse, an almost fully-fledged transactional account accessed from a mobile phone.” The bank’s transition includes a new environmental, social and governance framework for all its processes. “We raised our first green bond in June, which was oversubscribed, and we’re excited about deploying it into our pipeline of green projects that is focused on energy, water and sanitation,” the CEO enthuses. “In general, we’re looking forward to engaging in more partnership projects that help Namibia realize its development goals and that deliver on the promise the country holds for investors and the community.”

Another driving force within the banking sector is Bank Windhoek, primarily Namibian-owned, the country’s largest lender and its second-biggest bank in terms of deposits. With about 1,500 employees and total assets of around $3 billion, it is the flagship brand of Capricorn Investment Group, a financial services group listed on the country’s stock exchange. Its mission is to assist Namibian individuals, businesses and communities to reach their full potential, as its managing director, Baronice Hans, explains: “Our purpose is to be connectors of positive change.” As a relationship-focused institution, Bank Windhoek recognizes the value of its branch and ATM footprint. But it has also embraced mobile and online banking, and other technologies. “Our digital journey continues as customer needs evolve,” Hans states. “We’re concentrating on the interface between technology and people, transforming our channels so that clients have the convenience of digital services.” In sustainable financing, Bank Windhoek is a pioneer. It was the first bank in southern Africa to issue a green bond, which has been a prominent funder of solar and other green projects, Hans notes: “We’ve since launched a sustainability bond, which allows us to look at a broader scope of sustainability.” Supporting the government’s goals in this area, the bank is aligned with its wider economic objectives and is committed to catalyzing opportunities for Namibia, asserts Hans: “Our journey will continue to be one of growth, accountability and relevance to our country.”

Report Contents

Download the PDF

Download the PDF